Paybox

Paybox is a payment processing system built for Platform as a Service. Paybox processes every successful Redbox payment and distributes the funds to the balances of the Paybox accounts associated with the order. Once a week the account balances are settled and paid out to a nominated bank account.

Compliance and Regulations

Redbox and Paybox work together to ensure your marketplace is compliant with the stringent regulations around holding and paying out money.

Know Your Customer (KYC) obligations apply to any business that is processing payment on behalf of someone else. Paybox supports risk-based account verification processes for individuals and businesses receiving funds from your Marketplace with minimal friction and conducts screening as high-risk files are updated.

Funds are transferred to marketplace’s and business' Paybox balances, and balances are settled to the nominated bank account seven days later, on a weekly basis. This allows for any changes in the balance due to refunds before funds are settled. Only regulated financial institutions can hold funds that belong to another business, which is why Paybox funds are held in escrow with a compliant regulated financial institution until they are settled.

Paybox helps your marketplace stay current with global regulations, card network rules and strict industry security standards, including money licences around the world.

These Paybox features mean you can achieve compliance with minimal effort and ensure a safer payments business.

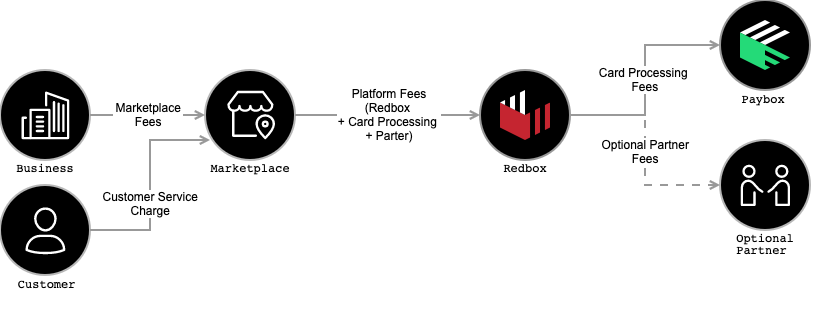

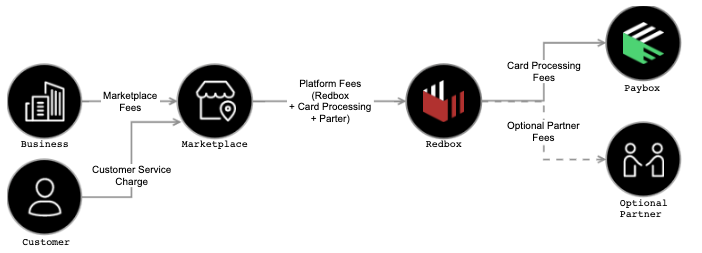

How Paybox funds flow is set up in Redbox

Redbox allows for the following fees and charges to be set at each level:

Customer Service Charge: A fixed service charge, charged by the marketplace to the customer, which optionally can be set to be charged on behalf of the business, for example, £0.50

Marketplace Fees and Charges: A fixed charge and/or percentage fee charged by the marketplace to the business, for example, 20%, or 15% + £0.20

Platform Charges: A fixed charge and/or percentage fee charged by the Platform to the marketplace, which is made up:

Redbox Fees and Charges: A fixed charge and/or percentage fee charged by Redbox to the Partner, for example, 10%

Partner Card Processing Fees and Charges: Paybox card processing fees and charges, for example, 3% + £0.20

Optional Partner Charge: This charge is an optional percentage that can be paid to the partner, which is deducted from the Redbox charges, for example, 1%

These charges from an invoicing perspective flow as per the following diagram, which means that if the total Platform Charges are 10% plus £0.20, the Marketplace charges are 20% and the Customer Service charge is £0.50, then the Marketplace retains 10% + £0.30.

Paybox charges flow diagram

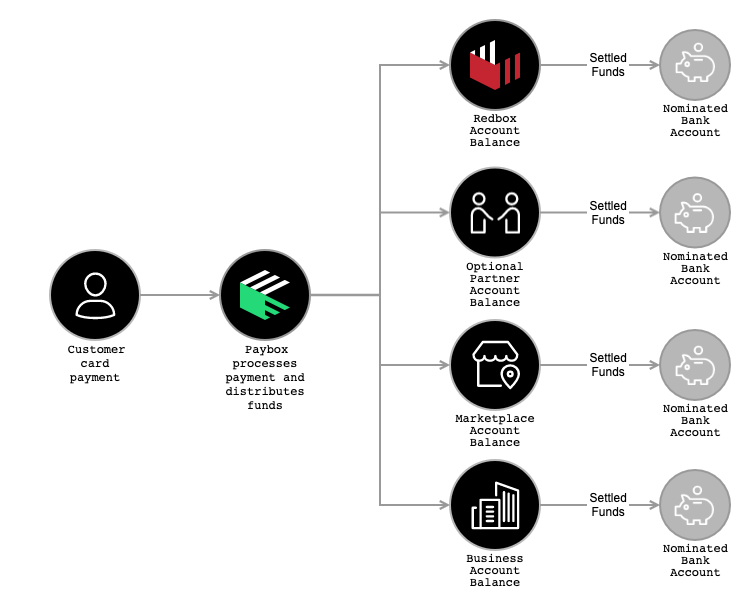

How these Calculated Funds are Distributed by Paybox

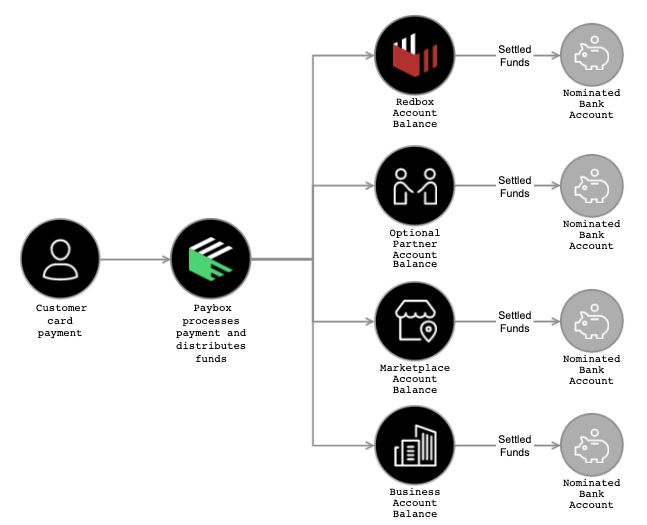

Paybox uses all the charges and fees set in Redbox to distribute the funds to Redbox, optional Partner, Marketplace and Business. Each of these transfers is a separate transfer to each account of the final calculated allocated funds and is added to the account balance.

Fund distribution diagram

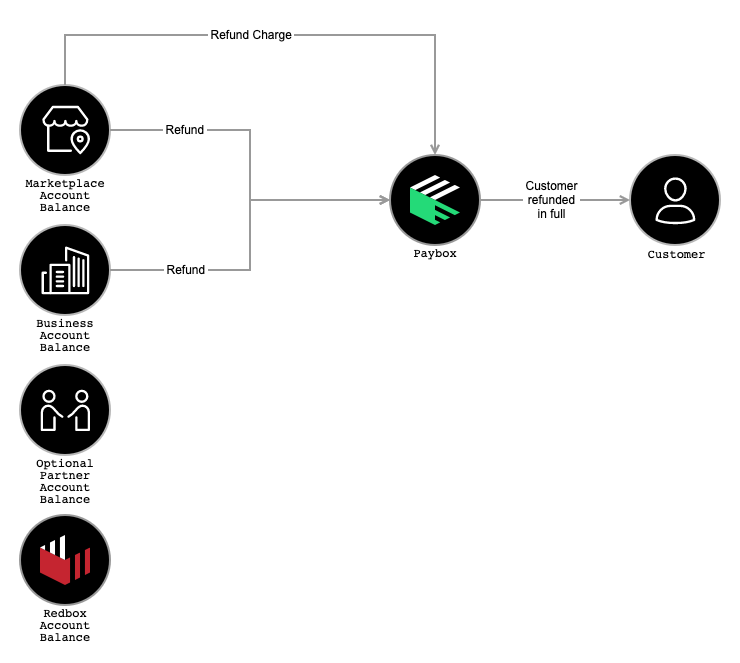

Rejected, Cancelled and Refunded Orders

When an order is created Paybox authorises the customer's card. If the order is rejected the card authorisation is cancelled and no card processing fees are applied. When an order is accepted Paybox captures the authorised funds and distributes the funds to the balances of the Paybox accounts associated with the order.

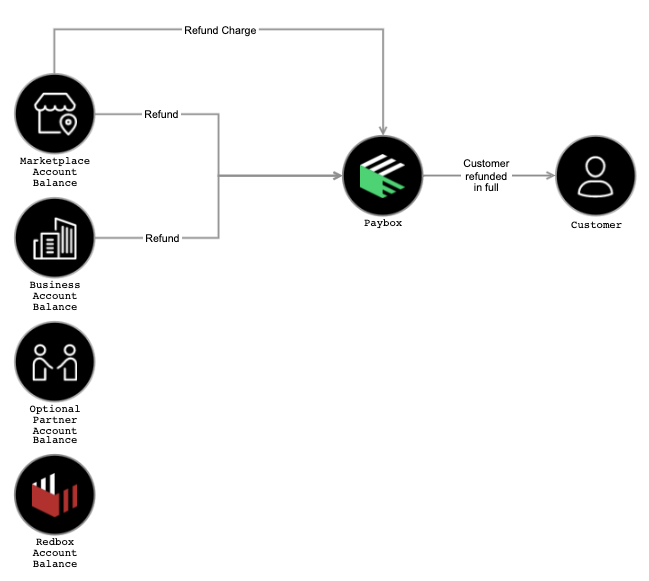

If an order is cancelled, or refunded in Redbox, Paybox will refund the customer in full. As the order and card have already been processed Redbox fees and Card Processing fees still apply.

To collect the funds to refund the customer Paybox refunds the Marketplace payout and Business Payout from the Paybox balances of these two accounts. To refund the customer in full an additional Refund charge (equal to the Redbox and Card Processing fees) is made from the Marketplace account to Paybox to payout the customer in full.

Here is a simple example:

The customer pays for a £10.50 order (£0.50 service charge)

Paybox updates each balance when an order is accepted:

Marketplace £1.50

Business £8.00

Redbox £1.00 (£0.50 Redbox and £0.50 Card Processing Fees)

Refund initiated

£8.00 refund from Business

£1.50 refund from Marketplace

£1.00 refund charge from Marketplace

The customer is refunded £10.50

Redbox has retained £1.00 (£0.50 Redbox and £0.50 Card Processing Fees)

Rejected, refunded and cancelled orders flow diagram

Other Paybox Charges

As Paybox processes all payments and payouts, other charges apply and depend on the version of Paybox your marketplace is using. See Standard or Enterprise for more information.

Risk and Fraud Management

Paybox leverages the best fraud detection in the industry to detect and block fraud using machine learning that trains on data across millions of global companies. By learning from millions of global businesses processing billions in payments each year we can assign risk scores to every payment and automatically block many high-risk payments.

Paybox also uses Strong Customer Authentication (SCA) to reduce fraud and make online and contactless offline payments more secure. To accept payments and meet SCA requirements, we have built additional authentication into the Redbox checkout flow. Not all payments require the customer to authenticate through 3D Secure and most payments under £30 are exempted as they are low risk.

Chargebacks

A dispute (also known as a chargeback, inquiry, or retrieval) occurs when a cardholder questions your payment with their card issuer. The issuer creates a formal dispute to process a chargeback, which immediately reverses the payment. The payment amount, along with a separate £20.00 dispute fee is then deducted from your account balance.

If your marketplace is subject to a chargeback we will help you submit the best possible response and allow you to provide all of the necessary text and images you feel are appropriate.