Payout Times & Frequency

Improved Payout Timing: Weekly Monday Payouts

We are changing our payout schedule to include more recent payments, to payout sooner, and to match our invoicing cycle.

Previously payouts on Friday included a week of transactions that were processed three days before the payout date (T+3).

Payouts will now include a week of transactions that are processed one day before the payout date (T+1), and the payout date is moving to Monday. This means every weekly payout will include payments from Monday to Sunday to match invoicing.

Change Schedule:

Friday, November 22nd: outlets and marketplaces will receive their normal Friday payout.

Monday, November 25th: outlets and marketplaces will receive a small payout for Saturday 23rd Nov and Sunday 24th Nov.

Monday, December 2nd: outlets and marketplaces will receive their first weekly payout that includes orders from Monday to Sunday.

After this payout, all payouts will be on a Monday and will include payments from the previous Monday to Sunday.

How This Works

Paybox provides credit services that allow us to advance payouts to businesses faster than the incoming funds we receive from processed transactions. In essence, we cover your payouts before we have received these funds, which allows you to benefit from improved cash flow. This credit facility is designed to support your business’s cash flow needs, ensuring timely access to funds without waiting for final settlement from all payment processors.

Payout Timing & Frequency

Whenever a transaction is processed by Paybox the funds are added to the pending balances of the Paybox accounts associated with that transaction. The balance then becomes ready for payout after one working day and is sent to the nominated bank account to arrive weekly on a Monday

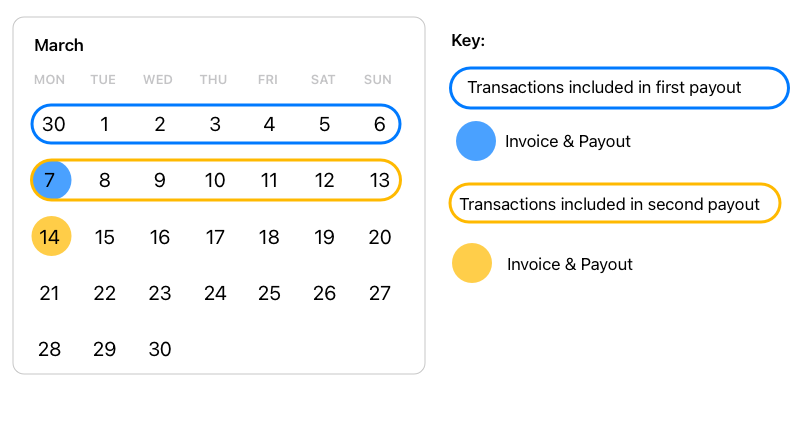

Here is an example payment schedule for two payouts:

The first payout for transactions made between the 30th of February and the 6th of March is paid out on the 7th of March.

The second payout for transactions made between the 7th of March and the 13th of March is paid out on the 14th of March.

Bank holidays on a Monday will affect this schedule, and your deposit will be delayed.

Payout calendar

How to locate Outlet Financials: Redbox → Businesses → Select a Business → Outlets → Select an Outlet → Financial

A breakdown of these payouts can be seen on your Paybox Financial tab on Redbox Management and on your Paybox Stripe Dashboard.

The first payout for every new Paybox account is typically paid out 7 days after the first successful payment is received, but not always. This waiting period can be up to 14 days for businesses in certain industries. This delay allows Paybox to mitigate some of the risks inherent in providing credit services.

This payout schedule is for Paybox marketplaces. Paybox Enterprise marketplaces will have a payout schedule determined by their marketplace agreement.

Paybox KYC Requirements

“Know Your Customer” (KYC) obligations for payments require Paybox to collect and maintain information on all account holders, especially for those utilising credit services. When registering for Paybox, you are required to provide personal and business information to verify eligibility for payouts and credit offerings. Accurate, up-to-date information is essential and supports compliance with regulatory requirements designed to protect the financial system.

As your business processes higher payment volumes or accesses credit services through Paybox, additional financial and identity information may be requested. We may also periodically confirm that your account details remain current. Requests for updated information will be sent via email and SMS and can also be accessed through your Paybox dashboard. Providing this information promptly is crucial, as failing to do so may lead to suspended payouts and potential limitations on credit services.